The Rising Importance of Fluorspar: A Critical Mineral in the Global Energy Transition

John Lee, CEO of CleanTech Vanadium Mining Corp. (“CleanTech”) (TSXV: CTV.v ; OTCQB: CTVFF), discussed the critical role of fluorspar in the global energy landscape and how CleanTech is positioning itself as a leader in the US critical minerals sector. Fluorspar, the primary source of fluorine, is emerging as a pivotal mineral in industries ranging from nuclear energy to electric vehicle (EV) battery production. This article delves into the insights shared during the interview, exploring the global supply dynamics of fluorspar, its critical applications, and CleanTech’s ambitious project in Western Kentucky, which positions the company at the forefront of this burgeoning market.

What is Fluorspar?

Fluorspar, also known as fluorite, is the mineral form of calcium fluoride (CaF₂) and the primary commercial source of fluorine. Fluorine, described by Lee as “the most corrosive and reactive element in the periodic table,” is integral to several high-demand industries. Its unique chemical properties make it indispensable in applications such as uranium enrichment, EV battery electrolytes, aluminum and steel production, semiconductor manufacturing, and solar energy systems. As Lee emphasized, “If fluorine doesn’t exist today, the world will cease to function.”

Fluorspar is processed into two primary grades:

The mineral’s critical status is underscored by its inclusion on the U.S. Department of the Interior’s list of critical minerals, highlighting its strategic importance to national security and economic development.

Global Fluorspar Supply Dynamics

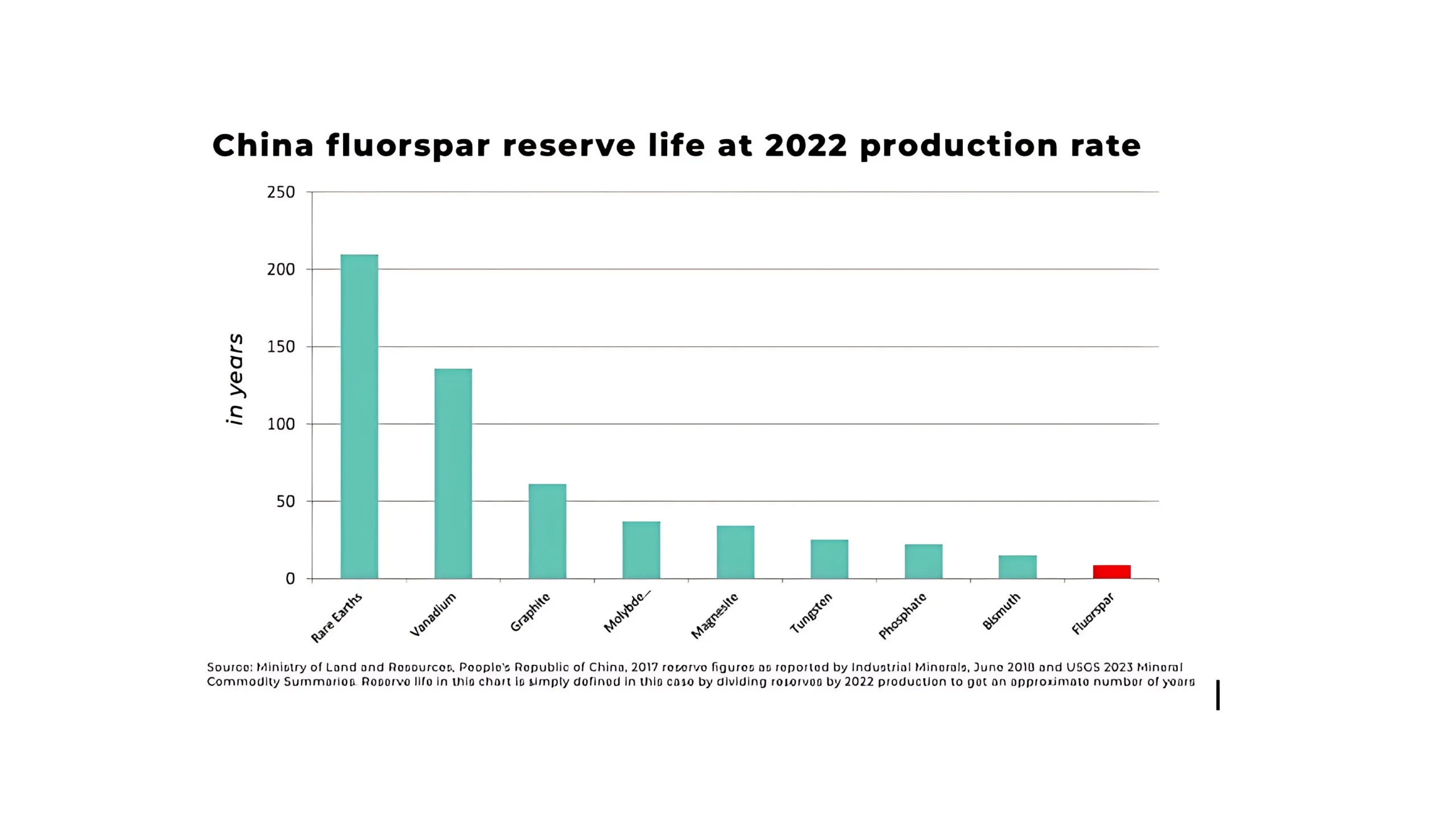

Historically, China has been the dominant player in the global fluorspar market, accounting for approximately 60% of the world’s 10 million tons of annual production. However, since 2022-2023, China has transitioned from a net exporter to a net importer due to increased domestic demand and depleting coastal reserves. This shift has triggered a significant tightening of global supply, with fluorspar prices rising by nearly 50% over the past 12 months. As Lee noted, “The situation on fluorspar is actually more severe and acute than rare earths,” where China also holds significant reserves.

The Chinese government has prioritized securing fluorspar resources, leading to a “frenzy in global fluorspar land grabs” over the past year. This aggressive acquisition strategy includes deals in regions like Africa, where China recently struck an agreement with Kenya for one of the continent’s largest fluorspar deposits. However, Lee pointed out that African fluorspar often fails to meet the stringent purity requirements for high-value applications like nuclear enrichment and EV battery production.

Figure 1: China rare earths reserves and fluorspar reserve comparison.

Beyond China, Mongolia and Mexico each contribute about 10% to global fluorspar production, collectively accounting for over 70% of the world’s supply. The United States, consuming approximately 500,000 tons annually, relies almost entirely on imports from Mexico. However, as Lee highlighted, this dependency is posing challenges as the U.S. pursues energy and resource independence under current policy shifts, such as those proposed by former President Donald Trump.

The current pricing dynamics reflect the tightening supply. In Europe, the Cost, Insurance, and Freight (CIF) price for fluorspar has reached $750 per ton, while Mexican fluorspar commands $550 per ton, and Chinese fluorspar is priced at $530 per ton. Just three years ago, these prices were below $400 per ton, and Mexican fluorspar was offered at a 20% discount to the U.S. market. That discount has now evaporated, signaling a structural shift in the market.

While Africa and Mongolia are seeing increased exploration, their contributions to high-purity fluorspar remain limited. Australia has also entered the market, with a recent $50 million investment in a fluorspar project valued at $200 million. However, Lee emphasized that the U.S. remains heavily reliant on Mexico, which now sells fluorspar at a premium due to global demand pressures.

Fluorspar’s versatility underpins its growing demand across multiple industries:

Lee projected that U.S. fluorspar consumption could quadruple to 2 million tons annually as the country expands its nuclear, EV, and semiconductor industries. Even at this level, U.S. demand would still be only a third of China’s current consumption, highlighting the scale of global competition for this resource.

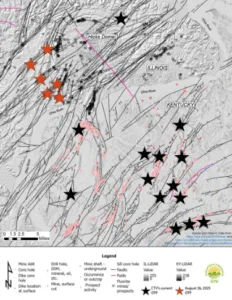

CleanTech’s Strategic Position in Western Kentucky

CleanTech Vanadium Mining Corp. is positioning itself as a key player in the U.S. fluorspar market through its extensive holdings in the Kentucky-Illinois fluorspar district. This region, historically responsible for 90% of U.S. fluorspar production until 1980, is one of the largest fluorspar districts in the world, comparable to Nevada’s Carlin Trend for gold. CleanTech controls over 8,150 acres across 20 distinct deposits, with historical resources estimated at 10 million tons—sufficient to meet U.S. demand for over a decade at current consumption levels.

The company’s flagship project, the Tabb deposit, spans a 17-kilometer strike and has a historical resource of approximately 3 million tons based on 97 drill holes conducted by Honeywell. Other significant deposits include Babb-Barnes, Eagle, Susie Beeler, Big Four, Robinson Lasher, and Campbell-Crotser. These assets, 100% owned or under option, are located on private lands, minimizing regulatory hurdles from federal agencies like the EPA or Bureau of Land Management.

Figure 2: Green fluorite crystals specimen from Gaskin Mine, Illinois.

Historical Context and Current Opportunity

Fluorspar production in the Kentucky-Illinois District ceased in the 1980s when China flooded the global market with low-cost supply, and Mexican producers offered discounts of up to 40%. Companies like Honeywell and DuPont, which previously explored the region, abandoned their efforts when cheaper imports became available. However, with the evaporation of the Mexican discount and China’s shift to importer status, the region’s strategic importance has been reignited.

Lee described a recent site visit to the Kentucky project, noting visible fluorspar in tailings, waste dumps, and abandoned shafts. “It’s like going back in time 30 years ago,” he said, emphasizing the region’s untapped potential. CleanTech’s assets include over 730 historical drill holes and thousands of documents dating back a century, which the company is digitizing to support NI 43-101 compliant resource estimates.

CleanTech’s strategy is two-pronged:

CleanTech is exploring partnerships with major U.S. industries, including nuclear operators, aluminum and steel producers, and EV battery manufacturers like Tesla, Panasonic, or LG. Lee emphasized an “American-centric” approach, focusing on domestic supply chains to reduce reliance on foreign imports. The company has a royalty agreement with Oracle Commodity and is open to joint ventures or offtake agreements with strategic partners. CleanTech also intends to pursue DOE (and other federal) funding opportunities.

With a market capitalization of $20 million, no debt, and over $1 million in cash, CleanTech is well-positioned to capitalize on the fluorspar market’s growth. Insider buying has been significant, with 25 million shares traded in July and August 2025, representing 30% of the company’s float.

ESG and Regulatory Considerations

The Kentucky-Illinois fluorspar belt is located in a mining-friendly region with minimal environmental or social opposition. As Lee noted, “There’s no Aboriginals, no First Nations, no tree huggers.” The majority of CleanTech’s mineral rights are on private lands, reducing the need for federal permits. However, the company is still researching state-level requirements for drilling, mining, and processing facilities. Kentucky’s history of fluorspar, coal, oil, and gas production, combined with its pro-mining stance, suggests minimal regulatory barriers.

From an ESG perspective, CleanTech’s operations align with environmental sustainability and social responsibility. The company’s focus on processing existing tailings and waste materials minimizes new environmental impacts, and its strategic location in a traditional mining region supports local economic development.

Future Outlook

Over the next six months, CleanTech plans to:

Lee emphasized the urgency of the opportunity, stating, “The world is going to be running out of fluorspar faster than running out of uranium.” With global demand outpacing supply and prices on the rise, CleanTech’s Kentucky project positions it as a potential leader in the U.S. fluorspar market.

Conclusion

Fluorspar is poised to play a critical role in the global energy transition, driven by its essential applications in nuclear energy, EV batteries, and advanced manufacturing. CleanTech Vanadium Mining Corp.’s strategic focus on the Kentucky-Illinois fluorspar belt, combined with favorable market dynamics and a robust development plan, positions the company to capitalize on this once-in-a-lifetime opportunity. As Lee aptly put it, “Fluorine is like the Robin to the Batman” of critical minerals—an unsung hero that underpins the technologies shaping the future.

For more information on CleanTech’s fluorspar initiatives, visit their website or contact John Lee at jlee@cleantechcv.com.

You can watch the interview with John Lee here:

Disclaimer: This article/interview is not a recommendation to buy any shares, products, or services. Always conduct your due diligence and consult with a financial advisor.Presented company has paid for the creation of video and article!

Sign up to our free monthly newsletter to recieve the latest on our interviews and articles.

By subscribing you agree to receive our newest articles and interviews and agree with our Privacy Policy.

You may unsubscribe at any time.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Websites store cookies to enhance functionality and personalise your experience. You can manage your preferences, but blocking some cookies may impact site performance and services.

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

You can find more information in our Privacy Policy.